Bringing Healthcare into Focus at Humana

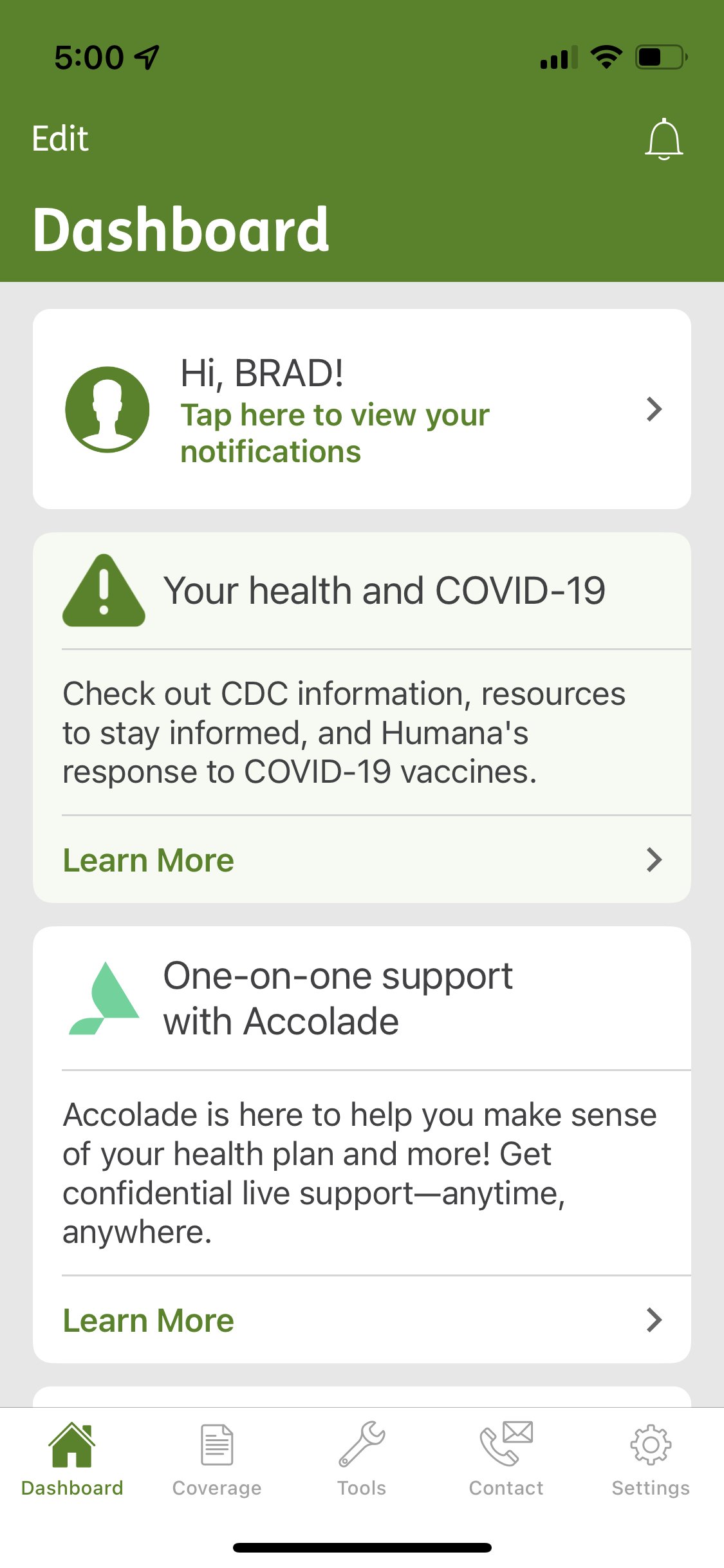

When I joined the Humana mobile app team in November 2021, the product seemed to have fallen victim to a common malady in mature enterprise applications - an emphasis on outputs over outcomes. There was a lot of energy spent in continuing to add more information and more functionality to the app throughout the years, but that fervor wasn’t matched in maintaining an understanding of evolving member needs in a crowded marketplace and an increasingly distracted world.

Before deliberating about what additional features to add 2022, my suggestion was to first take a step back in order achieve a deeper understanding of the current space. What was working well? What flows might be riddled with friction? Overall, what value did the mobile app bring for members? How did it help them save time and effort when it came to managing their healthcare plans?

STEP ONE: establish Baseline USABILITY

The first step was to establish a shared understanding of the strengths and weaknesses of the product itself. This was achieved by collaborating with Humana’s research team to calculate a quality of experience (QX) score for core features of the app. These scores would serve as a baseline and used as a comparison to evaluate proposed changes to the app over time. (shout-out to my colleague David Bellinger who did an amazing job with this report)

In the short term, the baseline research provided direction on quick UX wins in the upcoming quarter(s). For example, the drug pricing and medication management features had some of the lowest QX scores, so it was easy decision to make that the next design epic to focus on.

STEP TWO: define the purpose

In the long term, however, there were still questions to be answered about the role that the mobile app should play within the context of Humana’s omnichannel experience. After all, it was only one of many possible touchpoints a member could have with the company and the analytics pointed toward extremely low adoption considering the massive size of Humana’s total member base. So, what niche could it provide to justify its existence?

There was clearly an opportunity to more specifically define the experience - bring the product into focus for both members and business stakeholders. I worked with our content strategist to sketch out a strategy deck that would provide a vision for our internal team and guidance for others across the organization on how to best leverage our space within omnichannel experience. (shout-out to my colleague Elizabeth Wise who was instrumental in making this report a reality)

STEP THREE: align with Customer needs

The last step was to dig deeper into the motivations and behaviors of our specific member base. Via analytics, we had some answers to the “what?” (ie what features, what screens do members visit) However, that’s only one part of the equation. We also needed to understand the “why?” and “how?” - why might a member use the mobile app instead of the browser version? How do they typically utilize it to answer an insurance question? To get these answers, we conducted moderated customer interviews with Humana members who used the mobile app on a regular basis.

The TLDR version? It’s all about empowerment. The participants told us they choose the mobile app instead of the web experience because of convenience (my phone is always on me), simplicity (I don’t have to sort through a bunch of screens/data) and instant gratification (I can get an answer now). And all of those factors together contribute to a increased perception of control. It all boils down to staying on top of managing claims and ensuring benefits are maximized. The increased autonomy builds the necessary confidence to lead to even more action and engagement - which can ultimately lead to more customer loyalty.

In review/summary

Overall, I think the key to success for the Humana mobile app lies as much in a philosophical change than any specific design change or feature enhancement. The research tells us that, above all, it’s just not about having more on the app, what’s really important to members is having more control. They just want a tool that allows them to self-service a few key tasks.

From a UX process approach, this can be best achieved by adhering to these two core concepts:

Designing for attention

Design experiences that respect people limited amount of time and attention they can devote to managing their insurance plan (especially within the context a mobile experience). Focus on the basic self-service tasks that can be done quickly, limit the cognitive load on each screen and provide a clear resolution or reward at the end of each user flow. In other words, keep it simple - because as Herbert Simon famously noted, “a wealth of information leads to a poverty of attention.”

Designing for behaviors

In order for a behavior to occur, three factors need to be present - ability, motivation and prompt. All of these factors need to be analyzed and refined in order for a given user flow (aka a feature on the app) to be successful. So, even if we were to design the perfect solution (the “ability”) to managing a given insurance task, it would be a moot point if the member doesn’t care about it (“motivation”) or doesn’t know about (“prompt”).